20 Excellent Facts For Selecting AI Stock Trading Platform Websites

20 Excellent Facts For Selecting AI Stock Trading Platform Websites

Blog Article

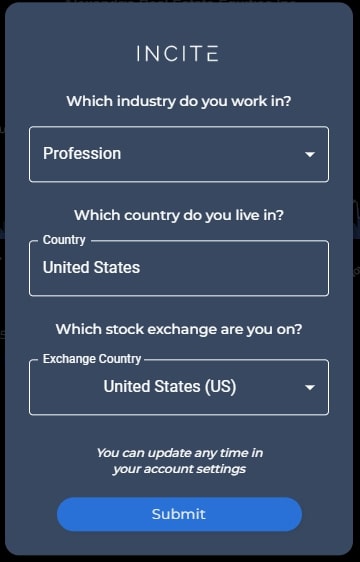

Top 10 Tips On Assessing The User Interface And Experience Of Ai Platforms For Stock Prediction And Analysis.

The User Interface and User Experience of AI trading platforms that use analysis and prediction of stocks are crucial to ensuring usability and efficiency. They also affect overall satisfaction. Even the AI models are reliable, a poorly designed interface can hinder decision-making. Below are the top 10 tips for evaluating UI/UX.

1. Examine the intuitiveness and ease of Utilization

Navigation: Make the platform easy to use by clearly defining menus of buttons and workflows.

Learning curve - Assess the speed at which a user is able to grasp the platform and understand it without extensive training.

Consistency: Seek out consistent patterns of design (e.g. buttons colors, buttons and so on.) throughout the whole platform.

2. Look for Customizability

Dashboard customization: Determine whether dashboards can be customized by users to display relevant information, charts, and metrics.

Flexibility in layout is essential You should be able to alter the arrangement and size of charts, widgets, and tables.

Themes and Preferences: Verify whether the platform supports dark and light modes, or other visual preferences.

3. Visualize Data

Quality of the chart - Make sure that the website has interactive charts with high resolution (e.g. candlestick charts and line charts) that include zooming, panning, and other features.

Visual clarity Ensure to ensure that the data is presented in a clear manner that includes labels, legends and tips-offs.

Real-time Updates: Check to see whether your graphs are updated with the most recent market data.

4. Test Responsiveness & Speed

Loading Time: Make sure that your platform loads quickly regardless of whether you are dealing with large data sets.

Real-time performance Check that the platform can process data feeds instantly without lags or delays.

Cross-device Compatibility: Check if the application works with different devices (desktops or mobiles).

5. The accessibility of the facility should be evaluated

Mobile app: Find out if there is a full-featured mobile application that allows trading while on the move.

Keyboard shortcuts - Make sure the platform is equipped with keyboard shortcuts available for power users.

Accessibility features. Verify the platform's compliance to accessibility standards.

6. Use the Examine Search and Filtering Function to examine your information.

Search efficiency: Ensure the platform is able to allow users to quickly search for indexes, stocks or other assets.

Advanced filters - Check to see whether users can apply filters, such as by sector, market cap or performance metrics, to reduce the number of results.

Saved searches - Make sure that the platform permits you to save frequently used filters or searches.

7. Look for Alerts or Notifications

Customizable notifications: Allow users to create alerts that are tailored to specific conditions.

Notification delivery: Determine that alerts are being delivered through multiple channels (e.g., email, SMS, in-app notifications).

Timeliness: Make sure that alerts are triggered promptly and accurately.

8. Evaluation of Integration with Other Software

Integrating brokers is essential to ensure smooth trade execution.

API access. Verify if the platform gives API access for advanced users to create customized tools and workflows.

Third-party integrations : Determine whether the platform is compatible with other applications, like Excel, Google Sheets or trading bots.

9. Assessment Help and Support Features

Tutorials on Onboarding. Check if new users can access tutorials.

Help center: Make sure the platform offers a comprehensive knowledge base or help center.

Customer support: See whether you will receive a quick response via the platform (e.g. through live chat, email, or by phone).

10. Test User Experience Overall

User feedback: Research reviews and feedback to determine overall user satisfaction with the platform's interface and user experience.

Free trial period: Use the platform for free and evaluate its usability.

What is the platform's approach to handling errors and edge cases?

Bonus Tips

Aesthetics are important, an attractive design can enhance the user's experience.

Performance under stress Test the platform to ensure that it's flexible and stable in periods of high volatility.

Visit the forums and community to see if there is an active forum or user group that allows users to exchange tips and feedback.

These tips will assist you in evaluating the UI/UX of an AI stock-predicting/analyzing trading platform to ensure they are user friendly, efficient and in line with your needs in trading. A great UI/UX will enhance your ability to make informed choices and execute trades efficiently. Read the most popular ai trading tools for more advice including ai stock trading app, ai investment platform, best ai trading app, best ai trading app, ai for stock predictions, ai stock picker, ai investing platform, ai for stock predictions, trading ai, options ai and more.

Top 10 Tips On Assessing The Speed And Latency Of Ai Stock Predicting/Analyzing Trading Platforms

When you are evaluating AI trading platforms that can predict or analyze price movements, speed and latency are crucial factors, especially for algorithmic traders and high-frequency traders. Milliseconds could affect the execution of trades and even profitability. Here are the 10 best tips for measuring the speed of your platform.

1. Data feeds that are real-time: How to analyze them

Speed of delivery of data - Ensure that the platform can deliver real-time information with a minimal delay (e.g. the sub-millisecond delay).

Data source proximity - Check to determine if the servers on your platform are within important exchanges. This can reduce the time for data transmission.

Data compression - Verify that the platform uses effective data compression techniques to improve speed of data delivery.

2. Test Trade Speed of Execution

Processing orders: The platform's capability to execute and process trades quickly once an order has been submitted.

Direct market access (DMA) Check if the platform offers DMA, which allows orders to be made directly to the exchange, without intermediaries.

Make sure you have a detailed report on the execution, which includes timestamps and confirmations of your order.

3. Examine the Receptivity of Platforms

Speed of the user interface (UI): Measure how quickly the platform's user interface responds your inputs.

Chart updates. Verify that charts and visualizations are updated in real-time update without lag.

Mobile app performance If you are you're using a mobile app, ensure it performs as quickly as the desktop version.

4. Verify that the infrastructure is low latency

Server Locations: Use servers that are low-latency, and located near major financial centers, or exchanges.

Co-location services: Find out whether your exchange offers this feature. This lets you host trading algorithm on servers located close to the exchange.

High-speed networks: Check if the platform uses fiber-optic networks that are high-speed or low-latency technology.

5. Backtesting the simulation speed and test backtesting

Historical processing of data: Find out the speed at which your platform analyzes and processes historical data.

Simulation latency: Make sure that the platform can simulate trades in real time without any noticeable delays.

Parallel processing: Determine if the platform uses parallel processing or distributed computing to speed up the complexity of calculations.

6. Estimate API Latency

API response: The performance of the platform's API is evaluated by the time it takes to respond to requests.

Rate limits. Examine what limits are appropriate on the API. This can assist in avoiding delays in high-frequency transactions.

WebSocket Support: Check whether your platform is compatible with WebSocket protocols for streaming data in real-time and at a low latency.

7. Test Platform Stability Under load

High-volume trades to test the platform's flexibility and stability, try simulated high-volume scenarios.

Market volatility Test the platform during times of extreme market volatility to ensure it can handle rapid price fluctuations.

Utilize the tools available on the platform to stress-test your strategies under extreme conditions.

8. Investigate connectivity and network

Internet speed requirements: Make sure your internet connection meets the speed recommended by your internet provider to ensure maximum performance.

Redundant Connections: To minimize interruptions, make sure that the platform can support redundant internet connections.

VPN latency - If you use a VPN to connect, be sure it doesn't introduce significant delay. Also, make sure the platform provides alternatives.

9. Make sure to look for speed optimization features

Pre-trade analysis The platform must provide pre-trade analyses to optimize the order routing and execution speeds.

Smart order routing: Find out if your platform is using SOR to locate the most efficient and speediest execution location.

Monitoring latency: Check whether the platform has tools to analyze and monitor latency in real time.

10. Review Feedback from Users and Benchmarks

Reviews from users: Perform studies to determine the platform's speed and latency.

Third-party benchmarks: Search for independently-run benchmarks or reviews that compare the speed of the platform with competitors.

Case studies and testimonials: Find out if there are any instances that prove the effectiveness of the platform's low-latency capabilities.

Bonus Tips

Free trial period: Try the platform’s latency and speed in real-world scenarios by using an online demo or trial.

Customer support: Ensure the platform offers assistance with issues related to latency, or optimization.

Hardware requirements. Verify whether the system is compatible with the hardware you are using like high-performance computers.

The following tips can aid in assessing the performance of AI trading platforms that forecast or analyze price fluctuations in stocks. It will allow you to pick a trading platform which best suits the requirements of your trading and eliminates the chance of delay. The ability to operate with low latency, especially in algorithms and high-frequency trading, is crucial. Even small delays could dramatically impact the profit. View the top rated inciteai.com AI stock app for more examples including ai trading tool, best ai stock prediction, best ai for stock trading, ai in stock market, chart ai trading, how to use ai for stock trading, ai stock trader, ai copyright signals, best ai trading platform, best ai stock prediction and more.